The contribution margin (CM) is the profit generated as quickly as variable prices have been deducted from revenue. Increase income by selling more items, raising product costs, shrinking product measurement whereas keeping the identical price, or focusing on selling merchandise with high margins. It includes the lease for your constructing, property taxes, the cost of shopping for machinery and different property, and insurance coverage costs.

In contrast, excessive fixed costs relative to variable prices tend to require a enterprise to generate a excessive contribution margin so as to sustain successful operations. The contribution margin is necessary because it offers you a clear, fast image of how a lot “bang on your buck” you are getting on every sale. It provides Contribution Margin perception into how your company’s merchandise and sales fit into the larger picture of your business.

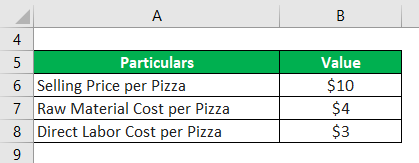

It enables a detailed evaluation of the price construction by separating variable costs from fastened costs. This helps corporations to determine inefficient value centers and take focused measures to scale back prices. Suppose Company A has the next revenue statement with income of 100,000, variable prices of 35,000, and stuck prices of 20,000.

Extra specifically, using contribution margin, your business can make new product selections, correctly price products, and discontinue promoting unprofitable merchandise that don’t at least cowl variable costs. The business can even use its contribution margin analysis to set sales commissions. If complete fixed value is $466,000, the selling price per unit is $8.00, and the variable price per unit is $4.95, then the contribution margin per unit is $3.05. The break-even level in items is calculated as $466,000 divided by $3.05, which equals a breakeven level in models of 152,787 units.

- ‘Sales Revenue’ is only a fancy word for the entire amount of cash your business makes from promoting its products or services.

- Nonetheless, you have to remember that you need the $20,000 machine to make all these cups as properly.

- Calculating the contribution margin for each product is one resolution to business and accounting problems arising from not doing sufficient financial evaluation.

Fastened Cost

Contribution margin measures the profitability of individual products based on their variable prices and can be utilized to find out the breakeven level. Contribution margin is used by internal administration to gauge the variable prices of manufacturing each product. As another step, you’ll have the ability to compute the money breakeven point using cash-based variable prices and glued prices. Examine the strains for determining accrual foundation breakeven and money breakeven on a graph displaying different volume ranges. The variable costs to produce the baseball include direct raw materials, direct labor, and other direct production costs that change with volume.

What Is The Difference Between Contribution Margin And Profit Margin?

Any remaining revenue left after overlaying mounted costs is the profit generated. Understanding and enhancing your contribution margin is important https://www.quickbooks-payroll.org/ for boosting profitability and improving business processes. By specializing in each income enhancement and cost management, you probably can ensure that extra revenue contributes on to overlaying fixed prices and producing revenue. In brief, contribution margin isolates the impact of variable prices on every sale, whereas gross revenue captures the complete price structure.

CM is used to measure product profitability, set promoting prices, decide whether or not to introduce a new product, discontinue promoting a specific product, or accept potential buyer orders with non-standard pricing. Typical variable prices include direct material prices, production labor prices, transport supplies, and sales commissions. Fastened costs embody periodic fastened bills for amenities rent, equipment leases, insurance coverage, utilities, common & administrative (G&A) bills, analysis & improvement (R&D), and depreciation of kit. The contribution margin can be utilized to calculate the break-even level, i.e. the purpose at which the revenue from a services or products exactly covers the total costs (variable plus fixed costs). Companies can use the contribution margin to determine which costs are required to at least cover the variable prices and contribute to masking the fixed prices. The contribution margin ratio is used by finance professionals to research a company’s profitability.

In basic, though, higher margins are better and point out that your corporation is bringing in a high revenue relative to your expenses. Decrease profit margins, then again, is usually a signal that some improvements may be made. Gross revenue is the greenback distinction between web income and value of products bought. Gross margin is the percentage of each sale that is residual and left over after the cost of goods offered is taken into account. The former is usually said as a whole quantity, whereas the latter is normally a share. Now, divide the whole contribution margin by the number of units bought.

Gross Margin

The break-even point is a critical metric in understanding the financial viability of a business, as it helps decide the minimal sales quantity required to cowl all costs. They can additionally be used to conduct a break-even evaluation, which helps you identify how many models you have to sell to cowl your company’s prices and begin turning a revenue. If an organization has $2 million in income and its COGS is $1.5 million, gross margin would equal revenue minus COGS, which is $500,000 or ($2 million – $1.5 million). As a percentage, the corporate’s gross revenue margin is 25%, or ($2 million – $1.5 million) ÷ $2 million.

Contribution margin analysis is the gain or profit that the corporate generates from the sale of one unit of products or providers after deducting the variable cost of manufacturing from it. The calculation assesses how the expansion in sales and profits are linked to each other in a enterprise. Contribution margin is the remaining earnings that haven’t been taken up by variable prices and that can be used to cowl fixed prices. Revenue is any cash left over in spite of everything variable and glued prices have been settled.

Analyzing your margins may help you make selections about where to cut costs or improve the effectivity of your operations. I also bet you’d like to really feel extra assured and at ease when making those choices. To obtain this, understanding key monetary metrics is important for making good, well-informed decisions. In our example, twice as many bicycles of type B than type A would have to be produced for the calculation to be appropriate.